We Built a Lending Marketplace in 30 Days. Here’s Why We Shut It Down.

A story about turning impossible constraints into breakthrough innovations and knowing when even breakthrough isn’t enough

Every Product Manager has built something that should have worked. The spreadsheet math was bulletproof. The execution was flawless. You shipped innovation after innovation.

But sometimes great metrics hide a dying business model.

Day 1: The Impossible Brief

June 24, 2025. My first day at my new job. Most people get a laptop and a buddy. I got a 0-1 project with a 90-day deadline to generate $1M in revenue.

“We’re building a lending marketplace for SMBs,” my new boss explained. “You start today.”

No onboarding. No ramp time. Just immediate ownership of what would become one of our most ambitious experiments.

The vision was compelling: Small businesses waste weeks on loan applications, getting rejected by banks, starting over. We’d build an intelligent marketplace that compressed weeks into minutes, matching businesses with the right lender instantly.

The constraints were... interesting:

- Small growth pod (including me, still learning everyone’s names)

- Targeting 90 days to revenue

- 1 confirmed lending partner

Day 1. Full ownership. Impossible timeline. Perfect.

Week 1-2: From 0 to Launch

While most teams would spend months researching, we had a different philosophy: ship immediately, learn from reality. In 14 days, we went from whiteboard to production.

The MVP was deliberately minimal, but the infrastructure wasn’t.

We built the whole analytics stack (Segment → Amplitude), comprehensive error tracking that let us watch sessions like reality TV (thanks for the T-shirt LogRocket), a hilariously simple but effective attribution system we called ‘caveman attribution’, just different landing pages for different platforms and even integrated with business registries because nobody should have to type their business address in 2025.

The early data was a masterclass in humility.

Of every 100 people who hit our landing page, 3 started the application. Of those brave souls, 75% rage quit when we asked them to connect their bank account.

The ones who did complete it? They were filling out loan applications squinting at our desktop optimized form on their phones (because of course 78% were on mobile).

That insight changed everything. These weren’t calm business decisions, they were desperate searches for capital when anxiety peaks. We weren’t building B2B software; we were offering SMBs a cashflow lifeline.

Week 3: The Strategic Pivot

With 1% conversion, I made a tough decision: complete redesign mid-flight. Not iteration, reconstruction.

The new architecture I proposed was radically different:

Progressive application: 1 question per screen with auto-advance

Mobile-first design: Optimized for thumbs, not desktop pointers

Smart sequencing: Pre-qualification by the end of the 4th question, scary stuff (bank connection) later in the app, after we’ve built some trust

Reduced cognitive load: 27 questions → 16, all multiple choice where possible

Results within 72 hours of launch:

Landing page → application start: 39% → 65% (67% relative improvement)

Application completion rate: 30% → 50%

End-to-end conversion: 1% → 4% (4x improvement)

Cost per signup: $60 → $43 (28% reduction)

The form completion rate of 50% wasn’t just good, it was industry-leading. Most financial applications struggle to break 30%.

Week 4-5: The Innovation Sprint

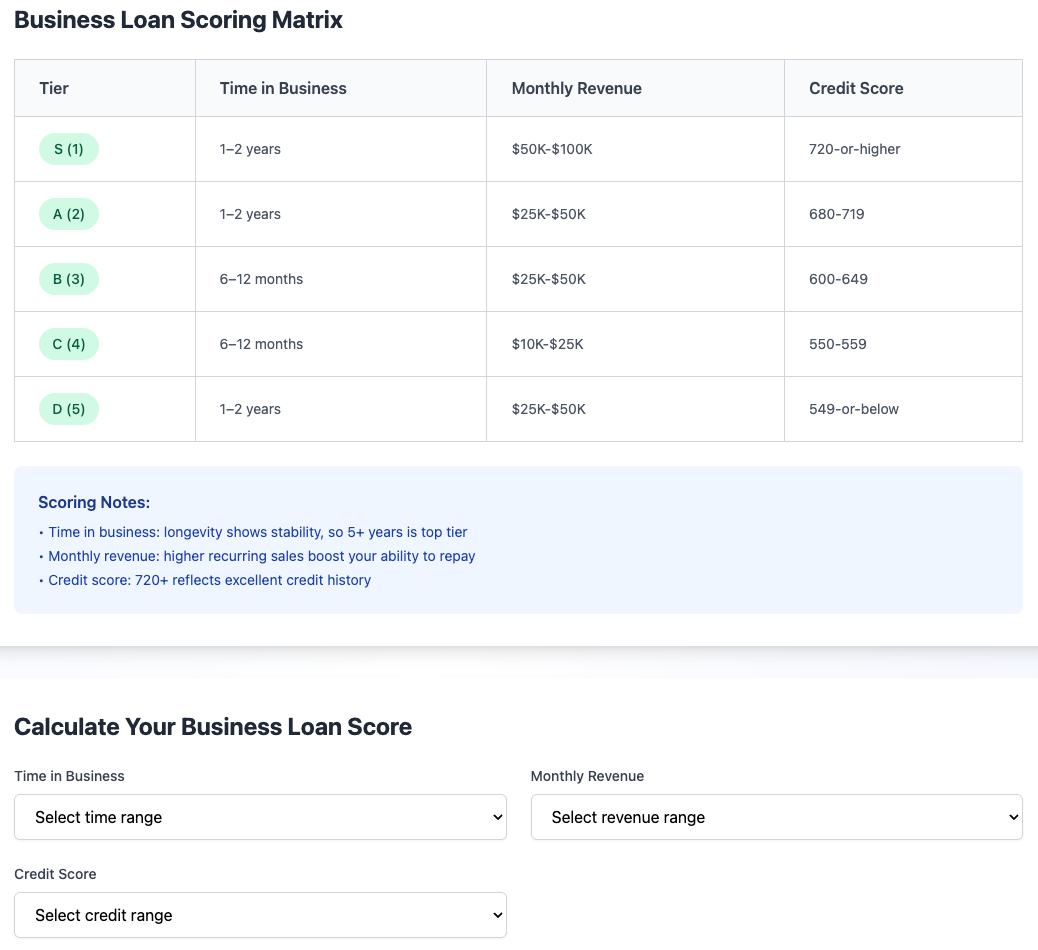

This is where we built something the company had never tried before, a lead scoring system:

The Lead Scoring Innovation:

Real-time qualification tiers: S, A, B, C and D (auto-decline) based on self reported revenue, credit score, and time in business

Meta Conversion API integration: a feedback loop sending lead quality data back to Meta

Automated routing: S-tier leads got white-glove treatment, D-tier were auto rejected (lending partners wouldn’t approve any D under any circumstances)

Self-improving acquisition: Each scored lead taught Meta what “good” looked like and the targeting improved

The technical implementation was complex but elegant:

Tier S: $50k-$100K+ revenue, 720+ credit, 12+ months → Priority queue

Tier A: $25-$50k revenue, 680-719 credit → Standard queue

Tier B: $25k-$50k revenue, 600-649 credit → Secondary partners

Tier C: $10-25k+ revenue, 550-559 credit, 12+ months → Priority queue

Tier D: <$10k revenue OR <6 months OR <550 credit → Helpful resources

I actual built a simple prototype to help visualize it:

https://zippy-clafoutis-f2aaa0.netlify.app/

This wasn’t just lead scoring, it was building a self-optimizing marketplace. Our CAC started dropping as the system learned, eventually reaching $181 per qualified lead (down from $400+).

Marketing Innovation & Attribution Mastery

Working with limited marketing channels (Meta’s financial services restrictions), I pioneered several approaches:

Attribution Innovation:

Created platform-specific landing pages for simplified tracking

Implemented “caveman attribution” that solved the attribution problem

Built custom conversion events that taught Meta about lead quality, not just volume

Messaging Breakthroughs:

“Approved before your bank calls you back” - our top performer

Mobile-first creative strategy (vertical video outperformed static by 3x)

Speed-focused positioning that resonated with anxious SMB owners

The result: marketing efficiency improved weekly, with cost per qualified lead dropping from $400+ to $181 while maintaining quality.

Week 6: The Hard Truth

By week 6, we’d achieved something remarkable, and remarkably challenging.

Our metrics were genuinely exceptional: applications up more than 50%, a 50% completion rate that made other fintechs jealous, and our customer acquisition cost had dropped by over 60%.

But funded deals, the metric that really mattered?

Basically zero.

Revenue?

A rounding error.

The unit economics exercise took 6 minutes and reset expectations from 6 weeks of intense effort.

Simple math: we’d need to spend nearly $2 on acquisition for every $1 in revenue.

And that was with our already-optimized funnel. I modeled every scenario.

Cut CAC in half again? Still losing money.

Double approval rates? Still underwater.

Triple both? Congrats, you’re at negative margins. There was no combination of improvements that made this work.

Decision Time

Six weeks in, I became the messenger for inconvenient math. The project I’d been hired to run on day one was improving every week but would probably never work.

My role wasn’t to decide its fate, but to ensure leadership had crystal-clear visibility into reality. I presented the unit economics and proposed options for how we could keep pushing with some timeline updates.

Eventually it was decided that we would reallocate resources and frame this not as failure but as strategic reallocation. We weren’t ending a project, we were reallocating resources strategically, to apply the learnings to our core application.

Leadership made the call, but they made it with conviction because the data was undeniable. That’s the real job of a PM: ensuring the right decision gets made.

The Platform We Actually Built

While the project only drove a small amount of direct revenue, we built lasting infrastructure:

Technical Assets:

Analytics infrastructure: Became company standard for all new products

Lead scoring engine: Adapted across entire product application experience

Conversion API integration: Now standard practice

Strategic Insights:

Discovered exact CAC thresholds for profitability

Mapped SMB lending landscape

Built relationships with 4+ lending partners

Created playbook for rapid marketplace development

Five Principles for 0-1 Products

1. Day 1 Ownership Beats Long Onboarding

Starting with full ownership on day 1 forced rapid learning and decisive action. No time for analysis paralysis.

2. Ship to Learn, Don’t Learn to Ship

Our ugly MVP taught us more in 2 weeks than 6 months of research would have. Real users with real money make real decisions.

3. Build Systems, Not Just Products

Every component was built for reusability. The product died; the infrastructure lives on.

4. Innovation Comes From Constraints

Limited time and resources forced creative solutions like the lead scoring system.

5. Strategic Courage Beats Stubborn Persistence

Killing a project with improving metrics takes courage. But recognizing fundamental flaws early saves resources for winning bets.

So that’s how 6 weeks into a new job, I proved to myself and the company that I could take ownership, drive innovation, and make hard decisions based on data, not ego.